Understanding Amazon FBA fees can be overwhelming for even the most experienced sellers.

It involves finding the perfect combination of the selling plan, product category, fulfillment strategy, and other variables to achieve your profit goals. Amazon does not make it any easier to understand as well with changes in their seller fees occurring periodically.

In this article, we’ll provide a detailed breakdown of the fees Amazon charges for storing, fulfilling, removing, disposing of inventory, and managing returns.

We’ll also share tips on how to maximize your business and take advantage of the e-commerce giant’s enormous potential.

By the end of this article, you will know exactly how Amazon charges you for selling as an FBA seller.

Our comprehensive guide to Amazon FBA fees is updated information for 2023 that will keep you ahead of the curve, enabling you to optimize your profits.

So, let’s dive in and explore the ins and outs of Amazon FBA fees to unlock your true profit potential.

How Much Does it Cost to Sell on Amazon?

The cost of selling on Amazon varies depending on the fees you have to pay. Generally, as a seller, you must pay selling fees, which is a monthly subscription, and a referral fee, which is a percentage of the price of the item you sell.

If you use the Amazon FBA selling option, you’ll also have to pay fulfillment fees, which are calculated based on the weight and size of the item you sell.

To determine the cost of selling on Amazon, you should consider all of these fees and factor them into your pricing strategy to ensure you are making a profit.

Read also: FBA vs FBM: Which is the Best Amazon eCommerce Solution?

Amazon FBA Selling Fees

Amazon offers two selling plans; the Individual Selling Plan which gives you the freedom to pay per sale you make, and the professional plan which requires you to pay a flat monthly fee.

|

Individual |

Professional |

|

$0.99/ item sold + additional selling fees |

$39.99/ month + additional selling fees |

In general, the professional plan is the best bet for Amazon sellers that really wants to get the best out of Amazon selling.

With the professional plan, you get access to additional features such as the ability to offer promotions and gift wrap, access to reports and analytics, and the ability to sell in restricted categories.

These extra features can help you increase sales and gain valuable insights into your business performance.

The professional plan is recommended if you plan to sell more than 40 items per month on Amazon. In the long run, the cost of the subscription is offset by more items you sell compared to the $0.99 per item fee on the Individual Plan.

Choose the professional plan only if you’re:

- Selling more than 40 units a month

- Into advertising your products

- Looking to see your product on top placement on the product detail pages

- Using advanced selling tools, like APIs and reports

Amazon FBA Referral Fees

Amazon, like Walmart, charges a referral fee for each item sold. A referral fee is the “commission” you have to pay Amazon for each item sold on their platform.

The Amazon referral fee depends on the product category to which the product belongs. Each product category has a different referral fee, but they are mostly between 8% to 15%.

| Categories | Referral fee percentages | Applicable minimum referral fee

(applied on a per-unit basis unless otherwise noted) |

| Amazon Device Accessories | 45% | $0.30 |

| Amazon Explore | 30% for Experiences | $2.00 |

| Automotive and Powersports | 12% | $0.30 |

| Baby Products |

|

$0.30 |

| Backpacks, Handbags, and Luggage | 15% | $0.30 |

| Base Equipment Power Tools | 12% | $0.30 |

| Beauty, Health, and Personal Care |

|

$0.30 |

| Business, Industrial, and Scientific Supplies | 12% | $0.30 |

| Clothing and Accessories | 17% | $0.30 |

| Collectible Coins |

|

$0.30 |

| Compact Appliances |

|

$0.30 |

| Computers | 8% | $0.30 |

| Consumer Electronics | 8% | $0.30 |

| Electronics Accessories |

|

$0.30 |

| Entertainment Collectibles |

|

— |

| Everything Else | 15% | $0.30 |

| Eyewear | 15% | $0.30 |

| Fine Art |

|

— |

| Footwear | 15% | $0.30 |

| Full-Size Appliances | 8% | $0.30 |

| Furniture |

|

$0.30 |

| Gift Cards | 20% | — |

| Grocery and Gourmet |

|

— |

| Home and Kitchen | 15% | $0.30 |

| Jewelry |

|

$0.30 |

| Lawn and Garden | 15% | $0.30 |

| Lawn Mowers and Snow Throwers |

|

$0.30 |

| Mattresses | 15% | $0.30 |

| Media – Books, DVDs, Music, Software, Video | 15% | — |

| Musical Instruments and AV Production | 15% | $0.30 |

| Office Products | 15% | $0.30 |

| Pet Products | 15%, except 22% for veterinary diets | $0.30 |

| Sports and Outdoors | 15% | $0.30 |

| Sports Collectibles |

|

— |

| Tires | 10% | $0.30 |

| Tools and Home Improvement | 15% | $0.30 |

| Toys and Games | 15% | $0.30 |

| Video Game Consoles | 8% | — |

| Video Games and Gaming Accessories | 15% | — |

| Watches |

|

$0.30 |

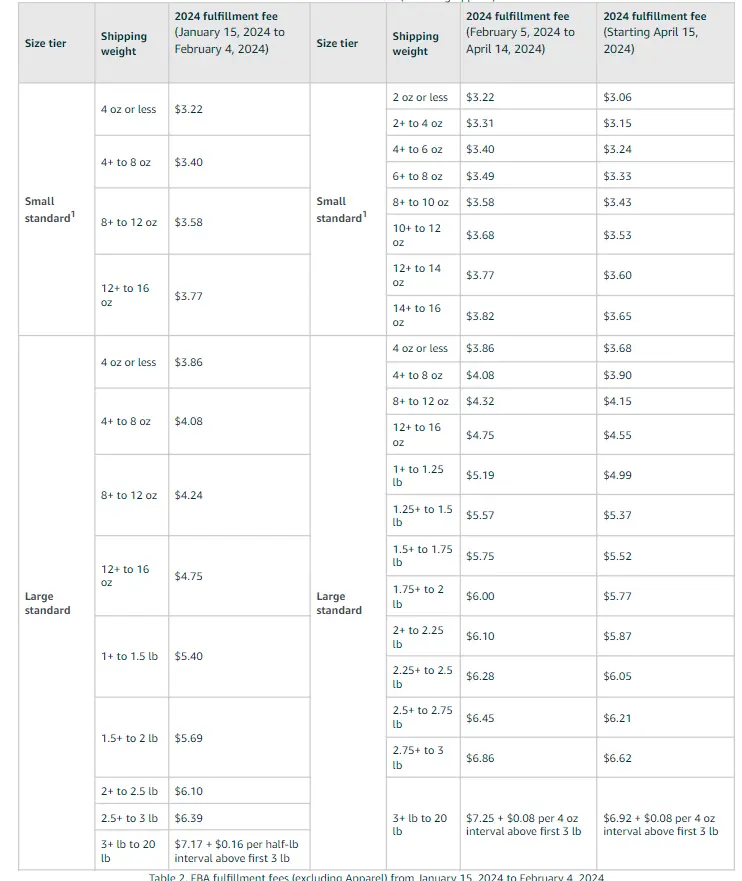

Amazon FBA Fulfillment Fees (Non-Apparel)

Amazon fulfillment fees refer to the fees that Amazon charges sellers for the services provided by the company’s fulfillment network.

These Amazon FBA fees are charged to sellers who use Amazon’s fulfillment services to store, package, and ship their products to customers.

The fees are calculated based on various factors, including the size and weight of the products, the time the products are stored in Amazon’s fulfillment centers, and the shipping destination.

The fulfillment fees cover a range of services, including receiving and storing inventory, picking and packing orders, shipping and handling, customer service, and product returns.

Below is a breakdown of the Amazon FBA fees by weight:

| Size Tier and Shipping Weight | Fulfillment Fee Per Unit |

| Small standard

4 oz or less |

$3.22 |

| Small standard

4+ to 8 oz |

$3.40 |

| Small standard

8+ to 12 oz |

$3.58 |

| Small standard

12+ to 16 oz |

$3.77 |

| Large standard

4 oz or less |

$3.86 |

| Large standard

4+ to 8 oz |

$4.08 |

| Large standard

8+ to 12 oz |

$4.24 |

| Large standard

12+ to 16 oz |

$4.75 |

| Large standard

1+ to 1.5 lb |

$5.40 |

| Large standard

1.5+ to 2lb |

$5.69 |

| Large standard

2+ to 2.5 lb |

$6.10 |

| Large standard

2.5+ to 3 lb |

$6.39 |

| Large standard

3+ lb to 20 lb |

$7.17 + $0.16/

half-lb above first 3 lb |

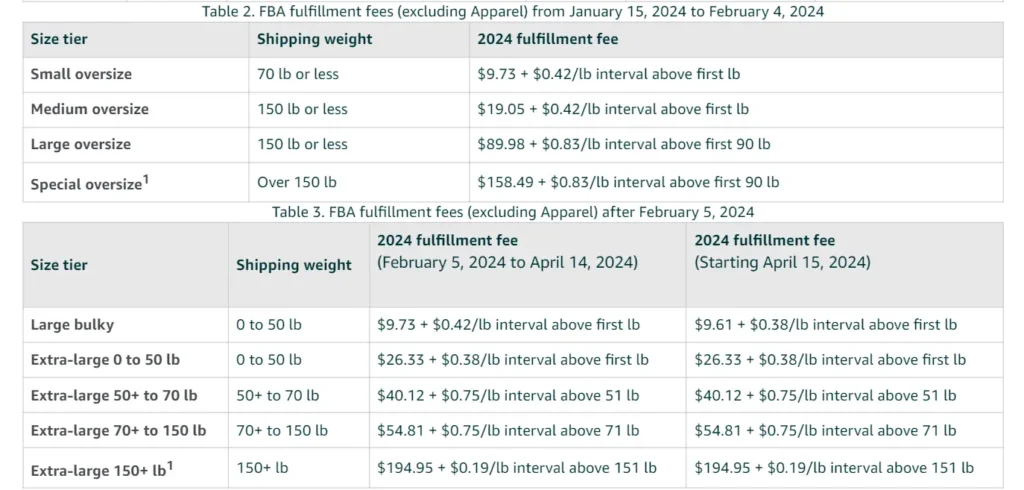

Amazon Fulfilment FBA Fees 2024 Update for Non Apparel

Starting February 5, 2024, Amazon will introduce more granular rate cards for standard-sized non-apparel products and introduce large bulky and extra-large size tiers. So from this data, we’ll have price tiers starting from 2 ounces or less and reaching 150 lbs.

Starting on April 15, 2024, FBA fulfillment fee rates will also be reduced for standard-sized and large bulky-sized products. Here are the size-tier updates with their respective prices

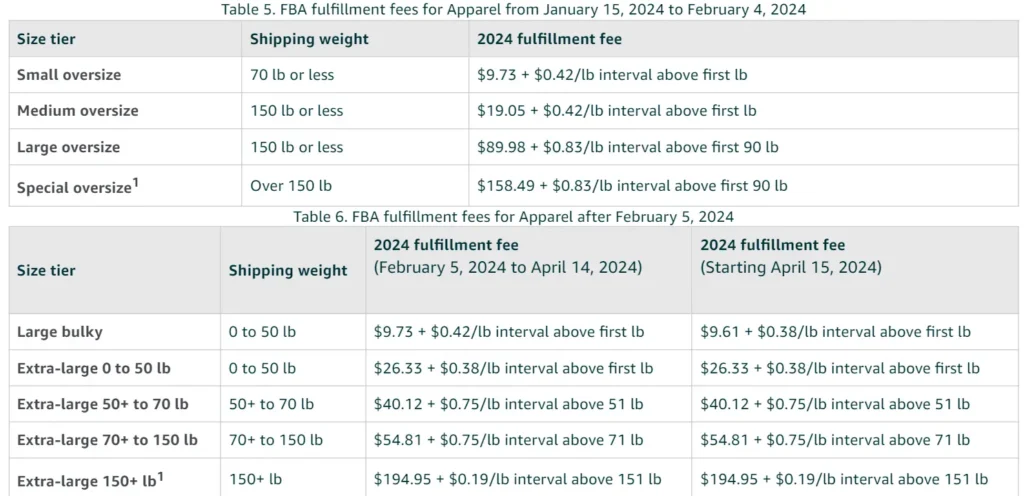

Amazon FBA Fulfillment Fees (Apparel)

Amazon FBA Fulfillment Fees for apparel items came into effect on January 17, 2023.

The standard items that weigh more than 0.75 pounds come under the category of oversize, excluding special oversize, the shipping weight will be calculated by whichever is greater; unit weight or dimensional weight.

Starting on February 16, 2023, the dimensional weight or the unit weight, whichever is greater is used to calculate the shipping weight for all large standard-size and oversized units, except for special oversize.

| Size tier and Shipping weight | Fulfillment fee per unit |

|---|---|

| Small standard 4 oz or less |

$3.43 |

| Small standard 4+ to 8 oz |

$3.58 |

| Small standard 8+ to 12 oz |

$3.87 |

| Small standard 12+ to 16 oz |

$4.15 |

| Large standard 4 oz or less |

$4.43 |

| Large standard 4+ to 8 oz |

$4.63 |

| Large standard 8+ to 12 oz |

$4.84 |

| Large standard 12+ to 16 oz |

$5.32 |

| Large standard 1+ to 1.5 lb |

$6.10 |

| Large standard 1.5+ to 2 lb |

$6.37 |

| Large standard 2+ to 2.5 lb |

$6.83 |

| Large standard 2.5+ to 3 lb |

$7.05 |

| Large standard 3+ lb to 20 lb |

$7.17 + $0.16/ half-lb above first 3 lb |

Amazon Fulfilment FBA Fees 2024 Update for Apparel

Amazon has also made some updates to the fulfilment fees for apparel products starting February 5, 2024. These changes are depicted in the tables below:

Amazon FBA Storage Fees

Because your products are being stored in Amazon’s fulfillment centers, Amazon charges storage fees to maintain your inventory. There are two types of FBA storage fees: monthly and long-term.

Monthly Storage Fees

Amazon charges you a monthly storage fee for storing your inventory at their warehouses.

These fees will either be deducted from your account balance or added to your credit card if and when your Amazon account doesn’t have enough funds to cover the fee.

|

Storage month |

Standard-size |

Oversize |

|

January-September |

$0.87 per cubic foot |

$0.56 per cubic foot |

|

October-December |

$2.40 per cubic foot |

$1.40 per cubic foot |

FBA Long-Term Storage Fees

The aged inventory surcharge (also known as the long-term storage fee) is another fee Amazon can charge you for storing your inventory from 271 to 365 days.

| Inventory assessment date | Items aged 181-210 days | Items aged 211-240 days | Items aged 241-270 days | Items aged 271-300 days | Items aged 301-330 days | Items aged 331-365 days | Items aged 365 days or more |

| Monthly (every 15th of the month) | $0.50 per cubic foot (excluding certain items) | $1.00 per cubic foot

(excluding certain items) |

$1.50 per cubic foot

(excluding certain items) |

$3.80 per cubic foot | $4.00 per cubic foot | $4.20 per cubic foot | $6.90 per cubic foot or $0.15 per unit, whichever is greater |

Other Amazon FBA Fees to Consider

In addition to these FBA fees, there are additional fees you might have to pay depending on certain situations.

Closing Fees

Amazon closing fees are fees that Amazon charges when you sell media items such as books, DVDs, Blu-Rays, video games, etc.

They charge a fixed fee of $1.80 per item, in addition to other fees such as referral fees and fulfillment fees.

High-Volume Listing Fees

Amazon’s high-volume listing fees are additional fees that is charged to sellers who list a large number of items on their platform. These fees are designed to offset the cost of processing and managing large volumes of listings.

Amazon considers you a high-volume seller when you create more than 100,000 listings per month and you be charged a high-volume listing Fee of $0.005 per listing for each listing over the threshold.

It’s important to note that high-volume listing fees are charged in addition to other fees such as referral fees and fulfillment fees.

FBA Removal or Disposal Fees

When a seller experiences a removal or disposal order through Amazon FBA, that order gets eligible to be charged for s removal/disposal fee when the shipments will leave the Amazon fulfillment center. The agreed-upon removal and disposal fees are below:

| Size Tier | Shipping Weight | Processing fee per unit |

|---|---|---|

| Standard-size items | 0 to 0.5 lb | $0.25 |

| 0.5+ to 1.0 lb | $0.30 | |

| 1.0+ to 2.0 lb | $0.35 | |

| More than 2 lb | $0.40 + $0.20 per lb above the first 2 lb | |

| Oversize and special handling items* | 0 to 1.0 lb | $0.60 |

| 1+ to 2.0 lb | $0.70 | |

| 2.0+ to 4.0 lb | $0.90 | |

| 4.0+ to 10.0 lb | $1.45 | |

| More than 10.0 lb | $1.90 + $0.20 per lb above the first 10 lb |

Returns Processing Fees

Amazon offers return shipping for products sold under certain categories. The FBA return processing fee is applicable in such cases.

| Items that are of Standard Size | Fee |

|---|---|

| Small (10 oz. or lesser) | $2.41 |

| Small (10+ – 16 oz.) | $2.48 |

| Large (10 oz. or lesser) | $3.19 |

| Large (10+ – 16 oz.) | $3.28 |

| Large (1-2 lb.) | $4.76 |

| Large (2-3 lb.) | $5.26 |

| Large (3-21 lb.) | $5.26 + extra $0.38 per lb. after initial 3 lb. |

| Items that are over-sized | Fee |

|---|---|

| Small and yet over-size (about 71 lb. or lesser) | $8.26 + an extra $0.38 for every lb after the first 2 lb. |

| Medium and yet over-size (about 151 lb. or lesser) | $9.79 + an extra $0.39 for every lb after the first 2 lb. |

| Large and yet over-size (about 151 lb. or lesser) | $75.78 + an extra $0.79 for every lb after the first 90 lb. |

| Oversized (special) | $137.32 + an extra $ 0.91 for every lb after the first 90 lb. |

The return processing fees are charged for every item returned in the clothing and shoe categories. Amazon does not charge return processing fees for items returned in watches, jewelry, luggage, handbags, and sunglasses.

Restocking Fee

If the item has been fulfilled by a third-party seller, the buyer can be charged a maximum restocking fee of 20%, even if the product was returned to the seller in its original condition within the 30-day duration. For most products, the return window is only 30 days from the delivery date.

To check for an item’s return window, a buyer can navigate to his/her Orders page and select Return/Replace Items.

|

Return Reason |

Restocking Fee |

|

Change of mind, returned the item intact within the |

No restocking fee. |

|

Change of mind, returned the item in the original condition outside of the return window |

Up to 20% of the item’s price. |

|

Damage incurred during shipping or caused by the carrier. |

No restocking fee. The seller pays for return shipping but can file a claim with the carrier or insurance company if they purchased insurance. |

|

The buyer receives a used or damaged item. |

No restocking fee. The seller can file a claim with the carrier or insurance company if they purchased insurance. |

|

The buyer changes their mind* about a purchase and returns a non-media item within the return window but the seller receives the item damaged or materially different than how it was originally shipped to the buyer. |

Yes. Up to 50% of the item’s price. |

|

The buyer returns a book within the return window with obvious signs of use. |

Yes. Up to 50% of the item’s price. |

|

The buyer returns a CD, DVD, VHS tape, cassette tape, or vinyl record within the return window that has been opened (taken out of the plastic wrap). |

Yes. Up to 50% of the item’s price. |

|

The buyer changes their mind* and returns open software or video games. |

Yes. Up to 100% of the item’s price |

|

The buyer returns an item they received materially different from what they ordered. |

No restocking fee. |

Tips to Improve Profit as an Amazon FBA Seller

With the amount of money you have to pay as Amazon FBA fees, you should have strategies at your fingertips to save you money. That being said, here are some tips you can use to turn healthy profit margins as an Amazon FBA seller:

- One way to reduce your Amazon FBA fees is to reduce long-term storage fees. Refrain from storing oversized items because long-term storage fees are calculated based on the cubic foot, meaning larger items that occupy more space will cost more to store in a fulfillment center over a prolonged period.

- If you bundle the 10 items you sell together and sell them as a single unit, then you’d only have to pay fees for one item, not 10. Plus, bundles are one of the top promos you can run on Amazon!

- If you have a professional seller account, you can check your Amazon FBA fees by heading to Seller Central. Just type in your product name or ASIN to get the calculated fees. The Amazon profitability calculator is a great tool that can give you an estimate of the FBA fees for any product you want to sell. All you need to do is type in the dimensions, weight, and category to get an estimate.

- Cut out any extra Amazon FBA fees by running an Inventory Health Report to see if you have any unfulfillable items taking up space in an Amazon warehouse. You can choose to sign up for the FBA Liquidations Program to help manage that extra stock or get the products returned directly to you.

- Don’t be afraid to call out any errors made by Amazon’s operating systems. If you discover that your Amazon FBA fee is an overcharge for any item, know that you can raise a ticket to reclaim your money. US sellers can find out more about filing an FBA inventory reimbursement claim here. FBA sellers should also note that you get a time limit of 9 months to rectify any inbound shipments in the US.

Amazon Seller Fees Update 2023

From January 2023, Amazon’s seller fee structure will be experiencing some changes. As of the time of this article, some of the changes have been implemented. It will be beneficial for you to know what these changes are and how they affect you as a seller on Amazon.

1. Fee Removal for some Categories

Amazon has stated that they will be removing the fees associated with selling collectible coins, entertainment collectibles, sports collectibles, and collectible cards.

However, this change means that these products will be moved to a different category, which may have different fees (either lower or higher) than the original category.

So, you may experience changes in the fees they are charged for selling these products after the re-categorization takes place.

2. Increased Aged Inventory Fees

Amazon is changing how they charge for storing inventory that has been in their warehouses for a long time.

Starting on April 15, 2023, Amazon increased the fees for inventory that has been stored for 271 to 365 days.

In addition, they will introduce new fees for inventory that has been stored for 181 to 270 days, with the exception of certain categories of products (clothing, shoes, bags, jewelry, and watches) in the US.

These fees are intended to encourage sellers to keep their inventory moving by removing items that are not selling well. The longer an item sits in an Amazon warehouse, the more it costs the seller to keep it there.

So, if you are a seller using FBA, you will want to keep an eye on your inventory levels and make sure you are rotating stock regularly to avoid these surcharges. Using good inventory management software can always help with that.

3. Storage Utilization fees

Amazon will be introducing a storage utilization surcharge for sellers who are using a lot of space in Amazon’s warehouses compared to how much they are selling.

The new fee will only impact sellers who are using a lot of space relative to their sales volume, estimated to be around 7.5% of sellers who use the highest volume of storage relative to their sales volume. The fee will take effect on May 1, 2023.

The surcharge will be based on the storage utilization ratio and will apply only if you have a ratio that is above 26 weeks and you meet the surcharge criteria.

The storage utilization ratio is calculated from your average daily volume stored divided by the average daily shipped volume over the past 13 weeks.

Amazon will calculate this ratio on the last day of each month and use it to determine whether you should be charged the storage utilization surcharge.

If your storage utilization ratio is too high (meaning you have a lot of inventory sitting in Amazon’s warehouses relative to how much you are selling), then you will be charged the surcharge on top of your regular monthly storage fee.